Media Sharing

Get More from ICL Directly to Your Inbox

Premier visibility for railcar tracking & management

Trusted 3PL expertise for finished vehicle logistics

End-to-end visibility for finished vehicle shippers

Turnkey solution to manage your yard operations

Optimize or design your transportation network with ease

Streamline your load for maximum efficiency

Even more custom service solutions to support all your logistics needs

We're proud to be a leader in product visibility and invoice auditing solutions throughout the logistics supply chain. Learn more.

Looking to join our team of award winning experts? Check out our open positions now.

We want to hear from you! Get in touch with us today.

For the fine print on our privacy policy, cookies and data, & more.

See how we keep your data safe with certified security practices, secure systems, and constant monitoring.

Do you ever hear about Precision Scheduled Railroading and wonder what it’s about? This article is the first in a two-part series, defining Precision Scheduled Railroading, examining the historical context of PSR, and analyzing the potential impacts on shipment tracking and management, both positive and negative.

Precision Scheduled Railroading or PSR is defined as “the operational method of running a railroad for maximum asset utilization by which freight movements are scheduled and managed on the individual carload (rather than entire train level).” In layman’s terms, the goal of PSR is to keep cars moving, reduce dwell and operate a balanced supply chain, which returns a more predictable service.

Precision Scheduled Railroading generally involves eliminating classification yards, consolidating dispatch centers, significantly reducing headcount, and reducing capital budgets with the ultimate objectives of substantially improving a railroad’s (profit) margins and returns on invested capital through greater asset utilization.

With PSR, customers can expect more reliable and faster rail service that will, in turn, help them strengthen their overall supply chain and reduce costs. More specifically, if the rail logistics company uses PSR, customers can also expect:

PSR, or Precision Scheduled Railroading, is a system of railroad logistics management created by legendary railroader E. Hunter Harrison. In the past, both container and general merchandise trains operated separately; under PSR, they are combined as needed. The catalogue of freight cars and locomotives reduced, and fewer workers were employed for a given level of traffic.

Harrison first implemented Illinois Central PSR, then implemented it at the Canadian National, dramatically improving the operating efficiency. Every Class 1 railroad in North America, except for the BNSF, has now implemented PSR.

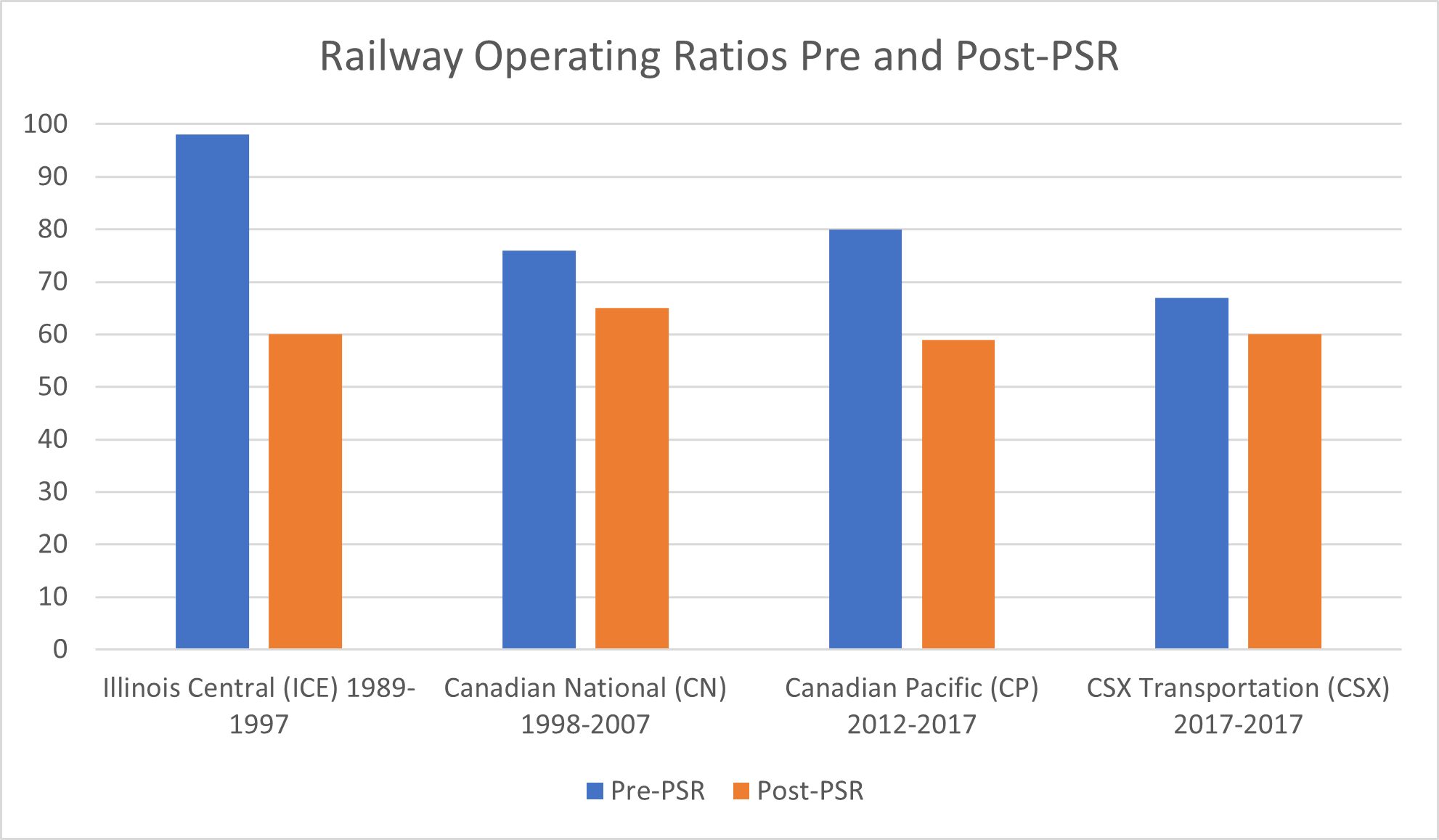

The railroad industry uses the Operating Ratio to quantify the financial results resulting from the implementation of Precision Scheduled Railroading.

The Operating Ratio is a financial term defined as a company’s operating expenses as a percentage of revenue. In simple terms, it represents how much a company needs to spend to make a dollar. This financial ratio is most used for railroads, which require a large percentage of revenue to maintain operations. In Railroading, an operating ratio of 80 or lower is considered desirable. An example of this is if a railway’s operating ratio is 60, the company will make 40 cents for every 60 cents spent.

A look at railroad operating ratios at the start and end of Harrison’s tenure as CEO at each railroad shows the consistency in results the PSR methodology promises. A lower operating ratio provides the railroad with free cash flow to strategically reinvest in the railway infrastructure to enable further efficiencies and revenue growth. It also offers the opportunity to share financial success with shareholders, which is one of the critical reasons, railroads have become more closely followed by Wall Street in the past ten years.

Since railroads are built for long trains that would move faster, it could be cancelled if a train didn’t meet a specific length, leaving customers without service for the day. These wrong logistics focus meant customer vehicles could sit for long periods before being picked up and delivered. This gave way to the implementation of PSR as we see it now. It also saw the deregulation of the railroad industry within the US.

At the beginning of the 1970s, a large percentage of U. S. railroad companies were in bankruptcy. A changing national economy, new technologies, and labor agreements negotiated at and for different times and circumstances led the Rail Freight industry to begin in serious trouble. Mergers, consolidations and abandonments in the industry, which had started in the 1950s, began to accelerate. This lead to the introduction of The Staggers Rail Act of 1980, the United States federal law that deregulated the American railroad industry.

One of the most significant impacts of deregulation on the railway logistics is that it helped to push prices down for those shippers fortunate enough to have a choice of rail carriers to move their products and with a book of business large enough that the competing railroads would battle each other for market share. With rates now being private contracts between shipper and carrier rather than published public rates, a change from Carrier A to Carrier B for a large business book would usually mean a rate decrease to win the business.

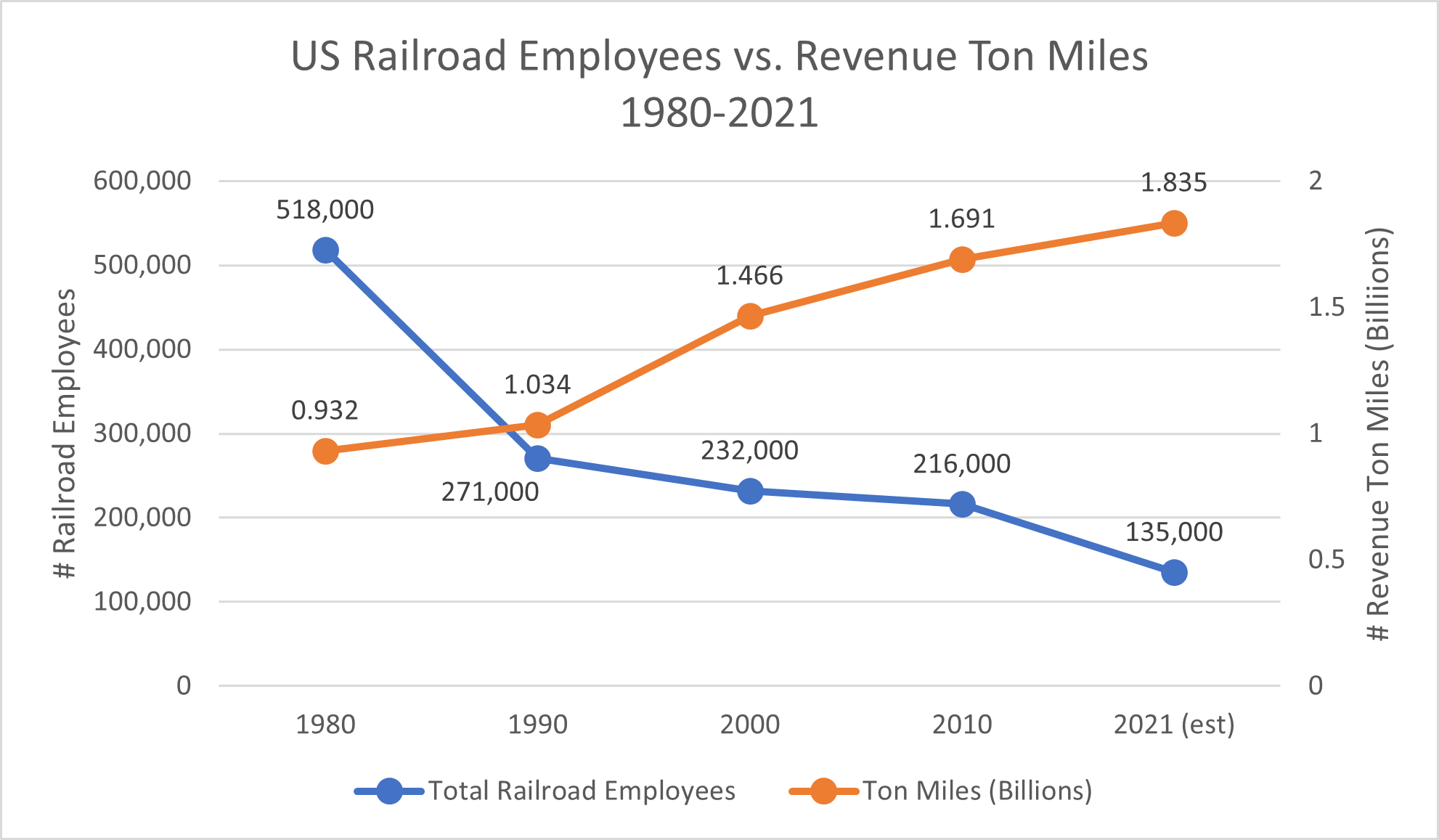

Simply put, deregulation put more pressure on railroads to operate efficiently to maintain and grow the book of business while still running with enough cash flow to reinvest in the network and keep Wall Street happy. A new operating model was needed to keep pace with the market conditions. Compared to the railroad industry’s revenue ton-miles, the number of industry employees shows the efficiencies gained since deregulation and PSR implementation.

See the graph below on the landscape of employees versus revenue form the last 50 odd years.

Sources: Federal Bureau of Transportation Statistics, American Association of Railroads

In the forty years since the deregulation of the U. S. railroad industry, the industry has consolidated down from forty Class I carriers to just five, and U. S. railroad route mileage has dropped by 50%. Employment has fallen by almost 75%. The number of ton-miles generated has doubled. Governmental oversight of the industry has been markedly reduced.

The big railroads have Operating Ratios in the low 60’s and are pushing for lower numbers still (and remember, “80 is desirable” according to the definition). Railroad stock prices have soared, and the railroad logistics industry has become lean and mean. Shouldn’t this benefit shippers also?

Check out Part 2 where we will examine what impacts PSR has had for rail shippers, both positive and negative. One approach shippers are taking to manage better their shipments in this new era of railroading is to implement supply chain visibility and management software.